Keep yourfirstchild . org as the hosting uses it

Overall trading flow

#1: Don’t lose money (Buffett)

- Takes longer to make money if have to make back what you lost.

- NEVER RUSH THE CONTRACT ADDRESS to wallet OR A SWAP TO A DEX

- Take everything into account including insight, and qualitative factors.

- Don’t have random positions (tradfi or crypto) which aren’t part of a system.

- Can lose money on shorts also if market rebounds.

- Careful of scams, eg fake Knight War ICO site. Check URL and original Discord/Twitter channel. URL can be altered from what you click on! Safer to copy URL!

- Only get links, and token and LP addresses from the official page or channel, linked from the official website, by an official poster. Even a PCS LP coin can be fake. Never interact with your wallet with any address which isn’t right – don’t even delete a coin, hide it. Do not respond to any DMs.

- Trades are expensive over time. Trade crypto monthly or at most bi-weekly (I checked annualised actual trading costs). Plan your trades to the end before making them (10-21)

- Quarterly check of broker stability. Keep up to date on Government plans on crypto.

Keep access to accounts with 2FA

- G auth account security

- Keep backup phone – factory reset, just use for authenticator.

- Give backup phone number – family member

- Keep G backup codes. Each can be used once (done). https://support.google.com/accounts/answer/1187538

- If lose phone:

- Sign out of G on the lost or stolen phone.

- Change your Google Account password.

Alpha is excess supply and demand for longs, and XS supply for shorts

- For DCF assume terminal value is in a dd/ss balanced situation, i.e. equilibrium multiple, and that XS dd or ss doesn’t continue.

- Examine COT for futures, and cryptoquant.io analytics for blockchain – calendarized to every Saturday morning in GCal.

- Crypto: 1) Study the industry, 2) Develop a written thesis: Indie games P2E – limited scope addictive loop (https://www.youtube.com/watch?v=7qDsK_a9rcg), play the game. Ticketing. Txn processors. File storage. 3) Buy and hold until your theory becomes reality. B: Being AHEAD of major trends is the pathway to 1000X gains.

Calendar

Screen for system changes daily in one place

- Daily:

- Screen for all system changes from V and factors in one Stockcharts list (set on Bookmarks bar)(this includes the LC and SP components of VHL), and oil backwardation.

- Exit BA then enter new BA trades.

- Weekly:

- Interest rates for FXCM

- Wednesdays: Crude stocks excl SPR on EIA site. See ‘4. Stocks of Crude Oil’, second column.

- Run V and C forecasts per “RDDn” below.

- Turn on/off system min/max weightings in RD, re-run for optimal weightings.

- Which voly to target? Change leverage so forecast voly for that combination of systems is 10% – per God 1/1/21 (i.e. 2nd tab of Hoadley file), rather than RD historical chart. RD is using forecast V per system for 21 days for the current allocations. The chart shows historical V, with constant allocation (while in reality I am changing allocations).

- Execute per the tables below and “Stick to your systems” below.

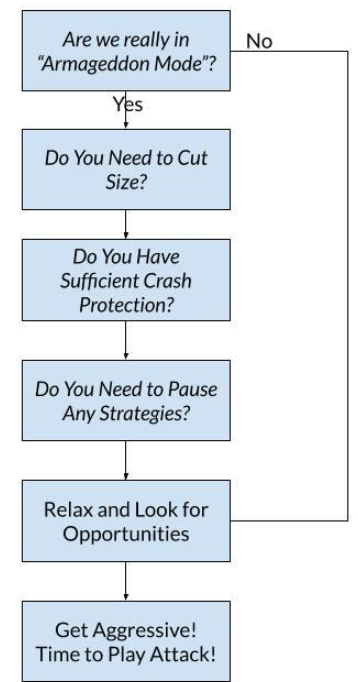

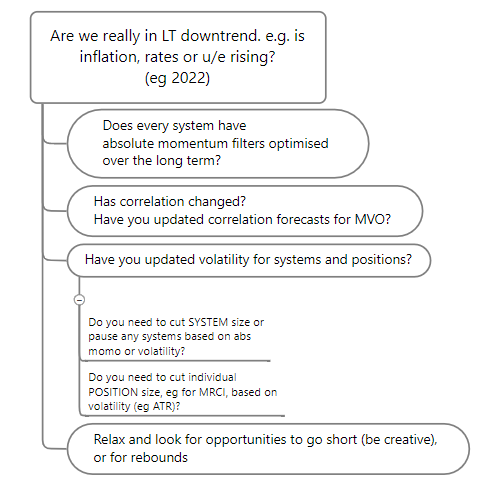

If: Large down day

Don’t lose money vs. SPY

- Don’t be over or underexposed:

- Check exposure net of hedging in Allocation Excel sheet – often can be greater than you estimate.

- Smaller sizing gives lower return and DD – you get what you ask for.

- Don’t trade too often: Selling and buying SPY every 10 days can lose 5% p.a. (or 7% p.a. on IGV) from friction and being out of market at the wrong time. Min 3 weeks, and don’t be out. If 0.05% slippage then min 4 weeks (WL).

- Be in correct sector/size/countries (see SC ratio charts): IWM vs SPY vs QQQ // vs MCHI vs EWJ vs VGK vs ILF

- Follow systems. Take every trade with the best execution method, for low and high VIX environments. (See ‘Stick to your systems’ and ‘Execution of large size changes’ below).

- Examine distribution well before testing system. Stand back. 30 metre view. Autocorrel. Lagged correl. Factors.

- Include correct slippage and comm in testing.

- Test on correct security (eg not VIX for VIX ETF products in 2011).

- Don’t shrink size in crashes and expand size in peaks unskilfully … follow tested RDD WL rebalance frequency testing (below). Similarly: Fear and FOMO … don’t sell in dips and buy at peaks.

- Execute well so getting fills, and mainly buy after down days and v.v.

- Have unrestricted leverage in account so can fully express systems. Use futures and options when I can.

RDDn

RDDn is really another system over the top of the systems. Trade it as tested in WL with slippage and comm for frequency and change thresholds.

- When to revise RDDynamic: If >5pt move (EMA5) after 3 wks (min hold 3 wks), or if >30 then 33% move up or 25% down (1/1.33). Never update just based on time else friction losses. Note EMA5(V) level of last update on chart in Stockcharts.

- Stocks only, or AntiRD if f/c V changed by 33% up or 25% down.

- RD is relative rather than absolute, so try to predict all variables, BUT: Only use a recent variable IF it is predictive, else using it could be worse than just using a long term average. Using recent V for BA is usually off-cycle with future V.

Stick to your systems

- Reduce execution size risk.:

- Change exposure a max face value of 10% of account size (actual after leverage), or 5% for volatile systems with leverage <0.75, such as volatility products (eg SVXY or VXZ), pension hedge and Beaten Down.

- eg: PLM cut 10% to 0% allocation, equals c.17% of account to 0% after leverage. PLM system has leverage >=0.75 so do this in two days.

- Can use Adaptive Algo (James does).

- Change exposure a max face value of 10% of account size (actual after leverage), or 5% for volatile systems with leverage <0.75, such as volatility products (eg SVXY or VXZ), pension hedge and Beaten Down.

- Psych = pleasure and pain:

- FOMO: If you miss out, you miss out. Better than losing money. The key is to hit lots of singles and eliminate mistakes (James).

- Selling to take profits (eg VIX in 02-2020): It may go down. It may also go up. I don’t know (James). Extensive backtesting should use more market related data than my feelings today.

- I may hold and it goes down. You may also roll a dice 6x and get 6 more than once. It is random.

- If profit as a percentage is larger than historical distribution then take it:

- Sell all or half; or if volatility is low then buy put, or sell underlying and buy call.

- Risk of position being too large (eg VIX in 02-2020):

- See execution risk above.

- If your sizing is too small, you won’t make the gains your backtesting shows.

- “Your systems are usually smarter than you are” (RB, and James agreed). They have been tested on lots of data over >10 years in up and down markets.

Execution

- The market has bids and asks. The close or last price doesn’t exist any more – it is historical even if one second old. I am a master of buying at the bid and selling at the ask.

- Little spread losses make a BIG difference over time.

- Gain from execution timing:

- Buying at close after down day and shorting after up day is about 1% p.a. better if do 12x per year. Not for currencies – which trend more ST. Need some discretion based on news flow as doesn’t always work.Tested L5Y and 1-07 to 09-20 (WL- same exit date to ensure same trade count).

- Avoid or reduce exercise and delivery risk: Don’t trade if couldn’t handle exercise of options or delivery of futures. Don’t leg in or out of futures spreads.

- Crypto systems

- Trade <= date for 2W and RD vol as forecast is for period.

- If wrong trade or size, get out immediately. Don’t wait for down/up day.

- Don’t enter on U.S. holidays. Entered BA on holiday (Mon), and left for next day (Tue). Was using stale Close data (from Thurs), as the last day’s Close (Fri) isn’t put into IB until the next trading day is about to open (01-20).

- Set the LMT for REL orders 4% away from current, for liquid stocks, but 8% away for volatile stocks but MUST make sure only executes in normal trading session and near open and close when more volume. Why? To ensure fill.

- REL orders in volatile market for diversifying risk exposure trades such as Anti-RD system and 2W system. LMT order for AGG and XLP both missed three days in a row in February 2020.

What if LMT orders not hit two (2) days in a row?

- If LMT order(s) not hit 2 days in a row (adjusting each day) MUST re do calculations.

- MRC entry: If LMTNBB not hit for three (3) days, adjusting each day, then leave as GTC for 3 weeks or until trade is close to ending. If not filled, not filled.

- MRC exit: If LMT mid not exited, then exit REL+MKT next day when the market is open.

- Inspired by research Value and Momentum Everywhere: https://pages.stern.nyu.edu/~lpederse/papers/ValMomEverywhere.pdf

- Enter/exit security / order type / size daily as tested, unless untested situation (Eg Sep11). Check trade levels and size match your testing platform, e.g. compare Excel to WL. Essential.

- Always enter at lower LMT to buy, higher LMT to sell, or REL order.

- Mindmaps printed in clear folder so no complexity excuse (eg for BA).

- Clear FX balances. Know when to apply the rules, and know when to break them (Seykota).

- Only break them if reduces risk, not adds to it.

- Check excess cash. Put in bonds: VCSH (1-3 yr corp) normally better. Crashes and rate risk: SHY (Govt).

- Good systems sometimes go bad. Don’t get married to a system, anyone’s system (MRC system 2018) // 1. Fear causes a retesting of the system, not abandonment. If the testing is statistically significant, act on it, trust it, else by definition will be doing something not maximal. Gut feel can be wrong, particularly w money (W Coast 10-18).

- New systems at half size as improve them.

- Never be over-sized, even intraday such as for election, as broker platform can crash (IB did 8-12-20)

Trade cheapest security (link)

Roll futures before closeout period

Roll in regular trading hours (morning) manually, unless spread looks accurate.

BA specific risks

Audit monthly (in G calendar):

- Download trades from IB.

- Do dataset of those stocks in WL, get unadjusted price data, and run script.

- Download trade list from WL.

- Use Vlookup for opening and closing trades separately, per security and date (concatenate security and date for lookup key).

- Compare fills in Excel.

- Compare comm as % and cps (must use absolute value for number of shares traded).

Daily: 1. Check fills (time taken as guide to liquidity). 2. MUST SET SELL ORDERS EACH NIGHT! DO BEFORE NEW ORDERS SO DON’T FORGET

Check account liquidity if increase BA size, so no margin calls.

Check if security is closed trading for the day before LMTCL order.

Note that Close data usually updated by IB after holidays, so wait to pre-market before submitting trades.

VIX Term Structure

Fair value calculator for S&P futures, plus best collateral

FV Calculator and collateral analysis.

S&P500 best collateral: IEF, fully collateralised (assuming not in a European retail account which can’t trade US ETFs). Negatively correlated. See G Sheets.

Risk acceptance (Trading in the Zone)

For BA: Max consecutive days unprofitable: 6 (up to 50 in a row profitable!). 64% of days are profitable. Worst daily return: -6.6%. Average daily return 0.13%. Can lose 4 weeks or 3 months in a row.

BA is not a perfect system. No system is.

For MRC: Can lose 5 weeks or 5 months in a row. Worst monthly return: -10%.

MRC

Interest rate decision days

- US: Released 2pm

- EU:

- NZ: https://www.rbnz.govt.nz/about-us/how-the-reserve-bank-releases-information

- The OCR and MPS are released at 2.00 pm, and the FSR at 9.00 am on the stated day, on the Reserve Bank’s Bloomberg and Thomson Reuters pages. The OCR and news release are published on our homepage and we tweet a link to the media release via our Twitter channel.

- RBA: Interest Rate Decision: a media release issued at 2.30 p