Spend <= budget regardless of trading gains, for life

Don’t spend trading gains. You can make $5 Mon-Th then lose the whole $5 on Fri (22-11-19)

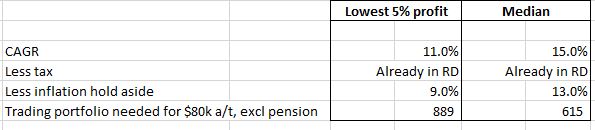

Withdrawal rate based on lowest 5% Monte Carlo, less tax and inflation

When spending from portfolio, take the lowest 5% Monte Carlo CAGR over 1,000 runs (from WL), less tax and inflation.

Include any one off increases and Govt. pension (nominal terms, 1.5% inflation), private pension (age 65, inflated at 5% nominal), and also savings on commitments (eg PDR mortgage ends age 67)(not inflated).

Model in Excel with random number for returns each year, with return from table above, and estimated standard deviation.

Result from Excel modelling

Need $700k min portfolio at median a/t return. Need $1,100k min at lowest 1% Monte Carlo average return.

I have no financial leaks globally

- A financial leak is a cash outflow with with value < cost, or where a cheaper option is available for the same value.

- Bank statements: NZ, PT, UK, Aus, Twise – txns incl insurance

- Broker accounts: commissions being greater than they should be, negative carry, futures in backwardation, data fees, uninvested cash

- Property accounts: PT

- Unclaimed employee expenses.