- I chose a very high financial deserve level. Volatility is part of wealth creation in investments; Volatility is real and natural.

- I deserve success because I pray and take action on the right causes. I don’t sabotage my success.

- No drama triangle: I am not consistently a rescuer, victim or persecutor (book on Self Sabotage).

- My family are very happy I am rich; they dont understand the stockmarket but they are very happy I am rich.

- I’ve given you gifts. Let go and play, and let your mind feel joy. I deserve abundant success (God, France, 09-19).

Trading in the Zone

Every trade has an uncertain outcome. Don’t try to avoid something that is unavoidable. I accept the risk.

Trade without fear or overconfidence, perceive what the market is offering from its perspective, stay completely focused in the “now moment opportunity flow,” and spontaneously enter the ‘zone’ – a strong virtually unshakeable belief in an uncertain outcome with an edge in your favor.

Freedom requires Free-Will Rules and Discipline for Success

Trading offers a gift (freedom to trade) and a risk at the same time. We are in complete control of everything we do, but there are no external boundaries to guide our behaviour, as with NLHE.

The structure we need to guide our behavior originates in our mind, as a conscious act of free will. Eliminating fear is only half the equation. The other half is the need to develop restraint.

Accept complete responsibility for the outcome of any particular trade. The market is full of opportunities. Developing a winning attitude is the key to your success.

Forget results and focus on the process

- Stop system hopping, chasing the holy grail. View trading for what it really is – a process of possibilities and probabilities

- Define your edge and follow the process of skill development and execution

- Trade a style that fits your personality and risk tolerance.

Take responsibility for everything that happens

- The market will do whatever it wants. I stop avoiding and start embracing the responsibility and risk.

- Your only two jobs are: trade selection and trade management

Trading is all about thinking like a chess player – anticipating all the possibilities and probabilities. Think in terms of probabilities

Trading doesn’t have anything to do with being right or wrong on each individual trade. I don’t try to predict outcomes.

I commit to taking every trade that conforms to my definition of an edge. By taking every edge, I increase my sample size of trades.

I Pre-define the Risk before Getting into a Trade

The best traders are in the “now moment” because there is no stress. There is no stress because there is nothing at risk other than the amount of money I am willing to spend on a specific trade. I completely accept what the market is offering me.

5 fundamental truths

- Anything can happen.

- You don’t need to know what is going to happen next in order to make money.

- There is a random distribution between wins and losses for any given set of variables that define an edge.

- An edge is nothing more than positive EV over a medium sized sample. Examine results in samples of 20 trades.

- Every moment in the market is unique.

The 7 Principles of Consistency

I am a consistent winner because:

1. I objectively identify my edges.

2. I predefine the risk of every trade.

3. I completely accept the risk or I am willing to let go of the trade.

4. I act on my edges without reservation or hesitation.

5. I pay myself as the market makes money available to me.

6. I continually monitor my susceptibility for making errors.

7. I understand the absolute necessity of these principles of consistent success and, therefore, I never violate them.

Carefree state of mind

When I am in a carefree state of mind, I won’t feel any fear, hesitation, or compulsion to do anything, because I have eliminated the potential to interpret market information as threatening. To remove the sense of threat, I accept the risk completely. I am therefore at peace with any outcome.

Embrace the mayhem (James 040620)

- Appreciating and accepting market noise – the “mayhem” – is the key to trading enlightenment.

- I realise that simplicity and robustness are essential to give myself a chance.

- I realise that good trading always “feels dumb” – because the short term results are dominated by randomness.

- I realise I will never and can never “figure out” the market. I realise I don’t need to figure out the market. It appears I can identify bets with a reasonable chance of being +EV. I systematically bet on many of those.

Luck

Some days you are lucky, some days you are not. Check no mistakes made, and distributions within historical bounds. FX hedging to future spending may have no implicit edge, but by definition it has value.

Some days, everything goes against your position, and maybe even BA trades don’t get closed.

- As long as security selection, sizing and execution is correct, then there is no mistake.

- As long as moves are within historical distributions (incl medium term av correlations) then there is no problem.

- A portion of the FX position may relate to targeting future spending and have no implicit edge. That is still good as it keeps assets in same ratio as future spending (eg shorting AUD to counteract CBA position).

Some days everything will go in my positions’ favor.

Small gains and losses add up

Small gains and losses add up.

USD200 per trading day = NZD80,000 per year which is enough to live off after tax.

I now “get” / understand volatility from experience

Lesson learned Th 5/12/19

Main account

- Day 1: Down $1k. All down – stocks, bonds, ST corporate bonds, ZIV and USD. Many futures fell also. Why? People selling USD assets as poor growth news, trade war, and impeachment risk.

- Day 2: Stocks down again per above. Bonds rallied as safe haven and expect lower LT yields. Sold SPY STRANG (REL+LMT) WAY above LMT price (+ve) as VIX opened higher.

- Day 3: Stocks and ZIV rebound, bonds decline as safer environment. Some futures rebounded. As SPY opened up, SPY STRANG LMT order not filled.

BA account

- Day 1: All 7 positions cratered with stocks in general (6 were new fills, 1 didn’t sell at LMT CL).

- Day 2: 6 of the 7 sold (LMT CL, often near highs), 1 fell further.

- Day 3: Stocks rebounded and opened up so only one fill out of five groups, and it was MTM profitable.

Diversification of positive expectancy systems works

On 31/1/20, BA fell sharply as the five positions didn’t get exited, when the market opened lower and fell over 1%. Lost about $1k. Long term this system has positive expectancy.

Simultaneously, near term lean hogs fell sharply on coronavirus fears. I had a spread which was long a longer dated future and it made over $1k. Combined with other trades, my net gain was $1k on the day.

Financial: Spend <= budget for life; no financial leaks globally

Spend <= budget regardless of trading gains, for life

Don’t spend trading gains. You can make $5 Mon-Th then lose the whole $5 on Fri (22-11-19)

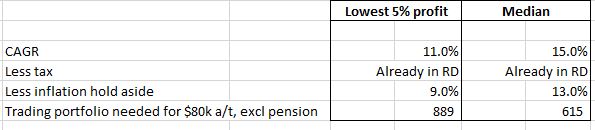

Withdrawal rate based on lowest 5% Monte Carlo, less tax and inflation

When spending from portfolio, take the lowest 5% Monte Carlo CAGR over 1,000 runs (from WL), less tax and inflation.

Include any one off increases and Govt. pension (nominal terms, 1.5% inflation), private pension (age 65, inflated at 5% nominal), and also savings on commitments (eg PDR mortgage ends age 67)(not inflated).

Model in Excel with random number for returns each year, with return from table above, and estimated standard deviation.

Result from Excel modelling

Need $700k min portfolio at median a/t return. Need $1,100k min at lowest 1% Monte Carlo average return.

I have no financial leaks globally

- A financial leak is a cash outflow with with value < cost, or where a cheaper option is available for the same value.

- Bank statements: NZ, PT, UK, Aus, Twise – txns incl insurance

- Broker accounts: commissions being greater than they should be, negative carry, futures in backwardation, data fees, uninvested cash

- Property accounts: PT

- Unclaimed employee expenses.

Margin

I never have positions auto-liquidated, ever (affects spread, commission and exposure adversely)

Preview margin implications before you submit a trade

Daily Margin Reports

Futures

Reg. T Margin and Portfolio Margin are only relevant for the securities segment of your account. Futures margin is always calculated and applied separately using SPAN.

Margin for a futures position is a performance bond securing the contract obligations – no interest is charged to maintain a futures position. Margin for futures is a cash or cash equivalent deposit that can earn interest while it works for you.

If you enter a commodities trade, cash will be moved from the Securities segment to the Commodities segment in order to facilitate the trade. This will cause your SMA to drop accordingly. Only the funds resting in your IBKR Universal Account’s Securities segment are included in SMA.

Once the contract is closed and the margin requirement is released from any statutory hold period, you can have the settled cash swept back to the Securities segment by selecting “Sweep to Securities” for your account’s Excess Funds Sweep setting.

Excess Funds Sweep

As part of the IB Integrated Investment Account service, IB is authorized to automatically transfer funds as necessary between your IB securities and commodities account segments to satisfy margin requirements in either account.

You can configure how you want IB to handle the transfer of excess funds using a feature called Excess Funds Sweep in our Account Management system. If you choose not to sweep excess funds, funds will not be swept except to meet margin requirements.

Definitions

- Look Ahead margin shows the change in margin values based on the next period change (End of trading session, start of trading session).

- Post-Expiry Margin @ Open (predicted) & Post-Excess (predicted) provides projected “at expiration” values based on the soon-to-expire contracts in your portfolio. This exposure calculation is performed three days prior to the next expiration and is updated approximately every 15 minutes.

What can cause my positions to be liquidated in a Reg T Margin account?

Anything that places your account in a margin deficit:

- Your Margin Cushion (Excess Liquidity) is equal to or less than zero.

- Your SMA balance is less than zero at 350pm (10m before the end of the trading day).

- Your account doesn’t have enough equity to receive or deliver post-option expiration positions. Given that the OCC processes the exercise and assignment after the expiration Friday close, liquidations in USD equities usually occur shortly after the open of regular trading hours (09:30 EST) on Monday or the next trading day. Any positions could be liquidated as a result of your account being in margin violation—the liquidation is not confined to only the shares that resulted from the option position.

- Pre expiry liquidations: To protect against these scenarios as expiration nears, IB will evaluate the exposure of each account assuming stock delivery. If the exposure is deemed excessive, IB will:

- Liquidate options prior to expiration; or

- Allow the options to lapse; and/or

- Allow delivery and then liquidate the underlying. In addition, the account may be restricted from opening new positions to prevent an increase in exposure.

Futures

- To avoid deliveries of expiring futures contracts as well as those resulting from futures options contracts, customers must roll forward or close out positions prior to the Start of the Close-Out Period. If a position exists at the Start of the Close-Out Period, the account becomes subject to an IB-generated liquidation trade. The liquidation trade will occur at some point between the Start of the Close-Out Period and the respective Cutoff.

Futures vs ETFs

You earn the total return when you buy and hold a real bond or a bond ETF. By contrast, bond futures are financed instruments, so you earn the excess return (total return MINUS financing cost). So all else equal, futures will ALWAYS perform worse than a bond, because of the drag from the financing cost (unless the financing rate is negative, which is happening in some parts of the world).

This may sound bad for futures, but it’s actually really easy to address. When you buy futures, you save a lot of cash since the margin requirement is minimal; if you invest that cash and earn a return on it, and attribute the return back to the futures, you’re basically back to earning the full total return again. This is known as “fully collateralizing” your futures. The question is, will the return you earn on cash be enough to offset futures’ implied financing costs?

In the buy ETF scenario you give up your cash and in turn get the bonds and earn their carry (less a management fee). In the buy future scenario you are not using much cash, but then you are giving up almost all of the return from the bond(s) in exchange for someone to finance them for you.

You are paying the market the repo rate to finance the underlying bond(s) for you. If the implied repo rate for the cheapest to deliver is < the 3 month bill rate (what you could invest the cash in), you are better off with the future.

You also save the withholding / dividend tax from holding the Bond ETF vs the hybrid rate of futures.

The bond ETF is the equivalent of holding the entire basket of bonds bought with your cash. You pay a management fee to the ETF sponsor for that privilege. The fees are small, usually around 15bp, but you need to be aware of them

You will have to roll the futures contract, which is annoying and can make you lose a few bp here and there in transaction costs.

Bond futures on CME:

Corporate bonds: None (Eurex contract is illiquid).

- TU: 2 yr Tsy

- FV: 5 yr

- TY/ZN: 10 yr (6.5-10 yr)

- TN: Ultra 10 yr (really targeted duration around 10 year).

- ZB: 15-25 yr

WN: Ultra Treasury bond: > 25 yr

Process:

- Check funding difference

- Check correlation daily and monthly last 5 years

Data

Charting software

Great list on Quantpedia: https://quantpedia.com/links-tools/

Very fast. Robotjames and Kris use it

Seasonax Seasonal data and patterns. Excellent.

USD 359. Great futures data

USD 99, 98 commodities, CLC Data. You control linking method.

https://eodhistoricaldata.com/

Brilliant. $20 per month

Quandl: “Far and away the easiest to deal with and least hassle” (James, bootcamp). $50/mth EOD. 50 futures contracts accounting for 90% of US trading volume with up to 50 years of history. Updated daily.

Sharadar share data – James uses it.

PC platforms

What about PC platforms?

NinjaTrader.com

- NinjaTrader.com/support/helpGuides/nt8/?charts.htm will take you to more details

Sierra Chart

For scalpy daytrader like stuff, Sierra Chart is excellent (robotjames)

- From site: It has been proven and trusted by investors/traders/clearing firms for more than a decade. Sierra Chart is extremely fast with a definite focus on high performance in all areas of the program. Sierra Chart supports all types of markets: stocks, futures, indexes, currencies/forex and options.

- Sierra Chart directly provides Historical Daily and detailed Intraday data for stocks, forex, futures and indexes without having to use an external service.

- Can download to Excel

- Sierra Chart does not use Java or .NET. It is fast 100% native C++ code. All of this means you have super high reliability, the best connectivity and support for connections.

- USD 218 per year

- There is no additional cost for historical futures data. Historical futures data is included with all Sierra Chart Service Packages.

- Sierra Chart provides a very powerful feature to create Continuous Futures Contract charts. Automatic back adjustment of data is supported. It is fully supported to replay Continuous Futures Contract charts. The following screenshot is an example of a Continuous Futures Contract chart

Norgate Data with Amibroker.

https://norgatedata.com/data-content-tables.php#futures

Continuous data based on last trading day. Uses settlement rather than close or open prices, which is not entirely accurate. Sierra Charts does it properly.

6 months = USD 149; 12 months = USD 270

Auto trading

QuantConnect, Multicharts

Volatility data

Interest rate data for FX (from BIS, which has tons of data)

Interest rate data is disseminated as csv files such as AUD.csv for Australian Reserve Bank interest rates, USD.csv for US Federal Reserve target rates, etc. The data is automatically updated from a source provided by the Bank of International Settlements.

Options backtesting

EDeltaPro : $99/mth, $39 if annual sub.

OptionNet Explorer : GBP500 per year

Other data

Short loan rates: https://iborrowdesk.com/filter

Use non overlapping data!

If you’re doing descriptive statistical analysis you usually want your samples to be non-overlapping (otherwise your samples contain a lot of shared data).