Odd lots

An “Odd Lot” is a stock order comprised of less than 100 shares of stock. Any stock order from 1 share to 99 shares is considered to be an odd lot.

Odd-Lot orders to initiate positions will not be routed to primary exchanges.

Odd-Lot orders can be routed to primary exchanges, but only if the order in question is to close out a pre-existing position.

IBKR will not direct-route odd-lot orders which initiate positions to primary exchanges, therefore these type of orders should be Smart Routed so that IBKR’s routing system can send the order to an ECN for execution. The exception is that odd lots can be routed to NYSE/ARCA/AMEX, but only as part of a basket order or as a market-on-close (MOC) order.

Odd-Lot orders are not posted to the bid/ask data on exchanges.

Odd-Lot orders are taken into the order book at the exchange they are routed to. When the exchange is able to match an order from the other side of the book with the odd-lot, it will be filled. This could lead to a delay of the execution of an odd-lot.

The low/high price reflected by the exchange take only trades of more than 100 shares, that’s why you can sometimes get a buy fill above the official high of the day (odd lot).

Make no mistakes

Never short an ETF

In control of the IBank. They put DGAZF trading OTC overnight and then screwed all the shorts.

Use manual LMT or SNAP TO PRIM (or SNAP TO MID) before close, not REL, on illiquid securities

James enters manually in last 90 minutes of day (but not last 10 minutes as spread widens). Most algos (eg REL) can be gamed by dealers.

He assumes getting worst fill. If not happy with it, then finds more liquid option. THEN: he bids between midpoint and ask if price trending. If no one interested, he drops it to fish, or just hits offer. Main thing is to “get it done”.

IB Adaptive Algo on liquid securities.

Auditing systems

Orders and fills

Get trades emailed to you automatically. Compare daily on 1min chart in Stockcharts or TradingView. For spreads look at chart in broker platform. If error, ask broker.

Commission

Monthly, calculate BA tiered commission paid vs what fixed would have been. Separate buy and sell trades as sell trades have the transaction fee.

BA

If issue, put current list in WL, same account size and voly lookback. Compare fills, size, profit, weekly returns.

Accounts

- Harmoney: https://www.harmoney.co.nz/sign-in

Pensions:

https://www.amp.com.au/wps/portal/au/AMPAULogin?iid=Login:MP:smarthero

https://customer.anz.co.nz/kiwisaver/Utility/Login.aspx?ReturnUrl=/kiwisaver/&Msg=1

https://www.direct.aviva.co.uk/MyAccount/login

Use phone app to login to broker

SMS can be slower, and need internet anyway – so if can’t use phone app then can’t login anyway (10-20).

Review pension allocations annually and with multiple long term trend filters (Todoist task)

Consider entry/exit fees and ICR p.a. The ICR (Indirect Cost Ratio) includes all of the Management Expense Ratio plus all other indirect costs, for example performance fees. Managed Funds may include both the MER and ICR, only one is charged with the ICR the more conclusive figure.

Testing protocol

Overall questions:

What (incl indiv stocks and duration) and When, in what allocation, when rebalance, how enter and exit? (insight 06-20)

“If you over complicate it, the more likely you are to just overfit to past noise, and fail to make money in the future – even if you were right about the general idea.

When I talk about “optimisation being bad” I mean a blind numerical optimisation without viewing the distribution of the data, checking its validity, understanding the trade-offs. You can’t outsource hard decisions about strategy design and configuration to an optimiser. You have to plot, investigate, understand.

I don’t know anyone who has successfully outsourced alpha generation to a neutral network… Nearly all successful professional trading operations are using machine learning techniques to solve large data processing problems, not to generate directional alpha.

Don’t fall into the trap of thinking the trading game is won by those who are the smartest or the best at maths, or coding, or who know the most about statistical learning techniques, or can derive black-scholes with their eyes closed…. that stuff isn’t the stuff that makes the difference. You have to be a pragmatic generalist, capable of grasping the big picture, and effectively implementing the things that matter.

The practical lesson is to always relate things back to the market – and make sure you could explain it to a small child without jargon. You think you need to understand these formal mathematical concepts, but you don’t. You need to get a really good intuition for the dynamics of asset prices. Once you have that, then understanding the maths will be easy. The master plots a bunch of time series charts and return distributions from various subsets of the data and makes a value judgement.” (James)

GDocs here

Am I making the systems and weightings really sweat?

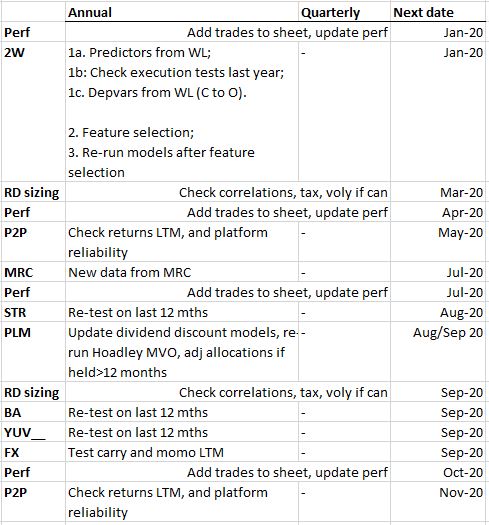

Annual and quarterly updates

Other Insights

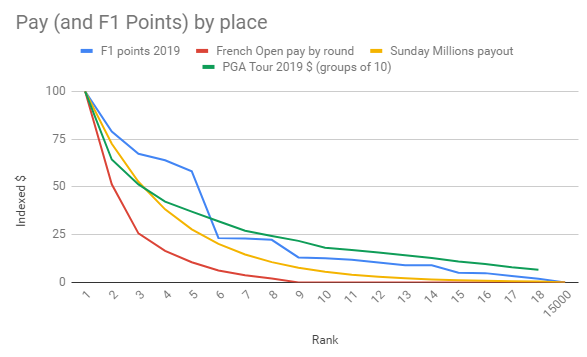

Trading is like F1 racing, poker, tennis, golf

The top few take almost all. 99.8% make ZERO or lose after playing costs.

Tending the Garden

Trading is like tending the garden. It grows over time. A long time. Take that attitude (insight 19-11-2019).

I Take And Manage Risk. I Have To (insight 19-11-2019)

- Life is risk.

- List all risks of each thing. Mitigate and manage them until reward is > risk, else say no.

- I embrace risk.

Customer service has power and can cut you off (19-11-19)

Always be charming to broker customer service

It is all about p (like my company name) given current, not current (05-03-20)

- The stock market is NOT the economy. It is 6-9 months ahead.

- “Bad thing ==> stock market is going to go down” isn’t reality. Reality: “Bad thing ==> stock market is already down”.

- Markets are constantly adjusting prices to reflect investor expectations about the future. As a result, meaningful changes in prices will only occur if investors receive new information that is inconsistent with current expectations. When this happens, investors experience a shock, which causes them to adjust the price of assets higher or lower to reflect this new reality.

- Don’t panic sell when a bad thing happens — unless you have informational edge from this point on, and don’t greed sell when high profits – unless you have informational edge from this point on.

- The tendency of nearly all active traders and investors is to under-perform by serially selling low and buying high. A potential source of edge is to do the opposite of what your fear is telling you to do.

- It IS important to be risk-averse – which you largely manage through diversification and appropriate sizing.

If wrong trade or size, get out immediately. Don’t wait for down/up day

If wrong trade or size, get out immediately. Don’t wait for down/up day. Did this with short ES hedge 04-20 and market went straight up 20% before I bit the bullet. Won’t have natural trade exit if not part of a system.

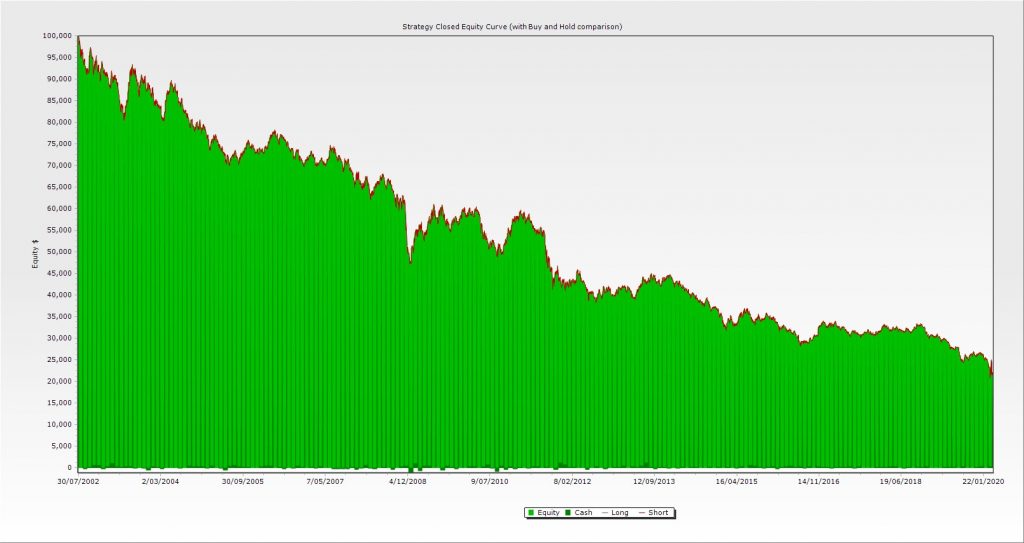

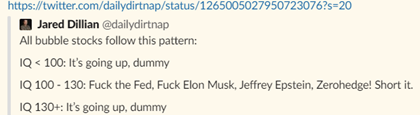

Don’t fight the Fed. Don’t short equity or debt

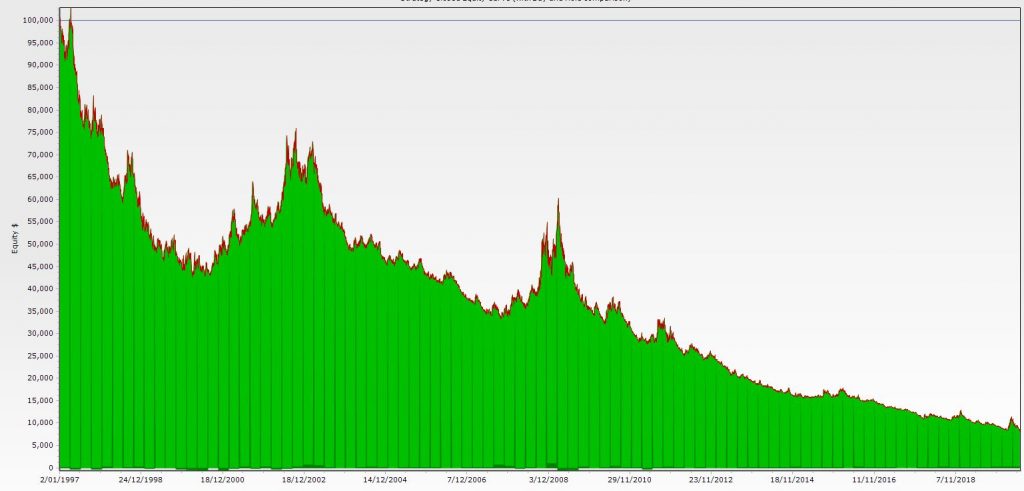

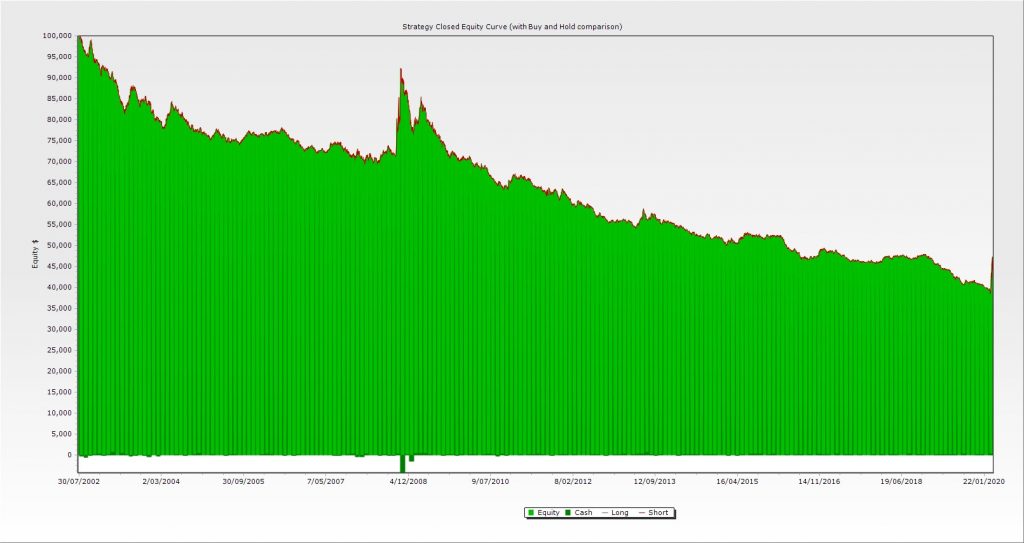

TLT short rebalanced monthly 2002 – 03/2020, no slippage

SPY short rebalanced quarterly 1997 – 06/2020, no slippage.

70% losing quarters. Looks the same with monthly rebalancing.

LQD short rebalanced monthly 2002 – 03/2020, no slippage

Right market size/exchange/sector (11-2020)

The US market is NOT homogenous. The following indices can all track VERY differently and make MASSIVE difference to the BA system and other systems: $COMPQ (Nas comp), QQQ (Nas100), SPY (S&P500), $OEX (S&P100), IWM (Russell2000), $XYX (Amex comp), $NYSE (NYSE comp).

Change, this moment (insight Good Friday 2020)

Trading in the ever evolving moment of now

- What combination of trades are best in this moment?

- What individual system weighting is best in this moment? Not what was best over the last 10 years. In two weeks, or one year, same questions.

- Life and the markets are dynamic – they change.

Druckenmiller’s prediction adages

- “Never, ever invest in the present. You have to visualise the situation 18 months from now, and whatever that is, that’s where the price will be today. It doesn’t matter what a company’s earning, what they have earned.”

- “Earnings don’t move the overall market; it’s the Federal Reserve Board/liquidity.”

- “The only way to make long-term returns in our business that are superior is by being a pig. Soros has taught me that when you have tremendous conviction on a trade, you have to go for the jugular.”

- “If something needs to be hedged, you shouldn’t have a position in it.”

- “Good investors are successful not because of their IQ, but because they have an investing discipline. But, what is more disciplined than a well-researched machine?”

- “George Soros has a philosophy that I have also adopted: The way to build long-term returns is through preservation of capital and home runs.”

- “Soros is also the best loss taker I’ve ever seen. He doesn’t care whether he wins or loses on a trade. If a trade doesn’t work, he’s confident enough about his ability to win on other trades that he can easily walk away from the position. There are a lot of shoes on the shelf; wear only the ones that fit.”

Risk and reward are 100% time related (RB 05-20)

Skew: How is skew best taken into account?

MC over period incl two crashes. Adjust sizing.

Simplicity on the other side of complexity

You’ve been able to synthesize the content into your own worldview, and you’ve discerned the essence of the idea in such a simple, direct way that you can communicate it to other people.

There is nothing to fear from corporate tax returns

Tax: There is nothing to fear from corp tax returns. In the end they are just numbers, dates, and pieces of paper (LP UK return in NZ 04-07-20)

Psychology: Comfortably living with crashes and reversals (Robot James 03-20)

- “Nobody would have called every turn in the market recently – whether they were in front of the screen 24 hours a day or not. Getting hit on turns is unavoidable.

- The main critical thing required to do REALLY well as a trader is to take positions (properly tested and sized) and be able to take pain (volatility) in the short term.”

- Resize based on:

- volatility forecasts to your target standard deviation.

- whether fixed income is the hedge it was ‘a million percent ago’

- volatility levels

- some discretionary input. In “normal” market regimes we’re almost entirely systematic. If I interfered during normal times I’d just mess things up. When it goes haywire you either size things down and carry on as normal… or you get in there and start swinging”

- “Long vol is really hard to systemise… you just don’t really have enough data and everything is very context dependent. You do the quant analysis – but then you have to trust your instincts to observe the way fear is feeding on itself. Needs screen time. For most people in environments like this you just want to size down and stick to the plan. And also have some wall street contacts who tells you quietly what’s up.

- You don’t want to plan for the very best case scenario.”

16% with 8% voly? No, need more voly.

“If you want to hit 16% CAGR after tax you are going to need to get all the systems in place etc – but you’re also going to need to gear it up a lot more than 8% voly and get ok with the volatility.”

Hard emotionally to cut exposure after 3 to 5pct down opens. Would you, James?

“Yeah of course… Don’t get hung up over pot money if you think it’s the right trade. No shame in going to cash for a while if you’re feeling very unsure what to do… Market is still going to be here next week.”

Sharp drop in bull market (06-20)

Don’t sweat it mate… these things happen… doesn’t mean the positions you had were wrong, or you could have had a panic-hedging crystal ball (because hedges weren’t on as sudden). I’m sure there are a lot of hindsight geniuses on the internet who say they got short because barstool sports guy said X or whatever and it was obvious we were gonna fall, but that is crap as you know.

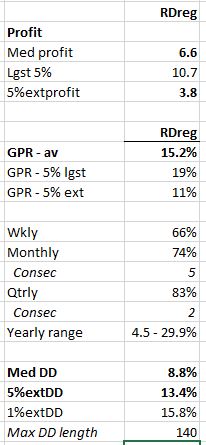

Best expectations

Trading is not an income. Trading is capital gains, with an expectation of three calendar quarters of capital gains per year, and a loss every fourth month (or four months in a row at worst).

Source: RD, and \Portfolio Management systems\Portfolio calculators

Leverage: 1.5x

Date: 23/08/20. Includes 25% FX