Dream

Flood of fast info in USA. Organise and simplify it into beauty and power like a concerto (25/1/20).

Organise and simplify flood of fast info into beauty and power like a concerto

B: I update my mental maps daily and evolve. I never stand still. // Nothing stays the same. Everything changes. Always. Forever.

Info coming in: Review 1x/day – evening.

- Twitter (curated feed. Follow who the top practitioners follow and who adds value)

- Telegram anncmt channels (official ones)

- Discord anncmts.

- Top movers and trends on Coinmarketcap.com

- For PCVs, claim and autostake daily. After mint fully redeemed (5d), compare staking to ‘minting and claiming’ to decide on the next 5 days and calendarise the next review: Calculator

- Weekly on chain analysis: Cryptoquant

How review it?

- Scan the info.

- See/hear ss/dd imbalances immediately.

- Write exit plan.

- Make crypto trades with monthly or at least bi-weekly holds (I checked annualised actual trading costs – expensive when compounded). Plan your trades to the end before making them (10-21)

- Size the oppo (35% of Kelly) in Crypto GSheets. Consider total exposure and correlations.

- Enter lmt+tick. Wait 30sec dep on market speed then cross spread. Automate exit plan, ideally.

- Write exit plan.

- If need to research more, put as task on Todoist if not urgent, else G Calendar if urgent. Do now if super urgent.

Always use checklist for coins and Defi

- Checklist: https://trello.com/b/bAofJElS/crypto-trading

- Do you believe your HODLs add value to and can change the world? No-> Sell for ETH. Yes –> Hold and DCA.

- Don’t buy pumps. BE EARLY!

- With Defi, maintain your share of the cashflow i.e. rewards must out-weigh coin dilution (Calculator Guy, Ad Infinitum)

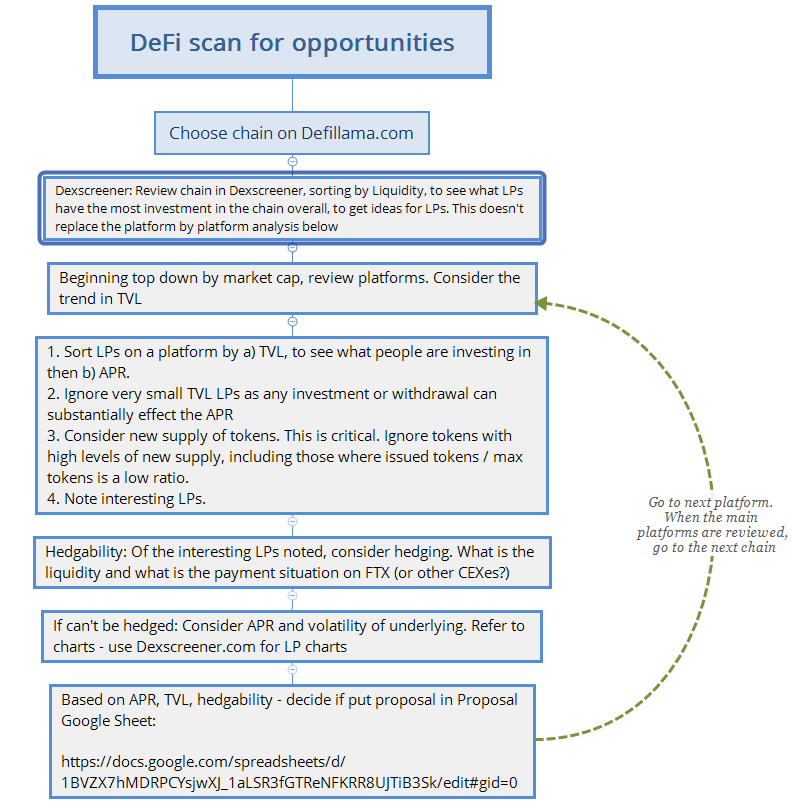

Finding LPs

Execution of Hedged Leveraged Defi

- Review bookmark list of sites (sites chosen from analysis on Defillamad and typed in Crypto GSheets)

- Yield – annual Perp funding = total yield.

- Require ‘yield > (1 – issued/total, that will be the price decline from inflation)’ so maintain share of the cashflow (Ad Infinitum).

- Always borrow the stablecoin, not the main coin! (else short the main coin!)

- Can see the effects of this in this calculator.

- Only do 2x leverage (50% debt), else too much value destruction in price decline.

- Only leverage an LP if it is hedged, as IL becomes massive in leveraged LPs (see calculator) cell K129 area

- Make sure you are not liquidated!

- Check debt level every 3 days and after large price drops: Buffer>30%

- Dynamic hedging every 3 days and after big move

- Adjust hedge # when # coins change – check ever: Within 10% threshold

- Check net yield including perp payments every 3 days

- Use tool from Max, with the yields pasted into my Excel sheet: Substantially > 20% and better than alternatives

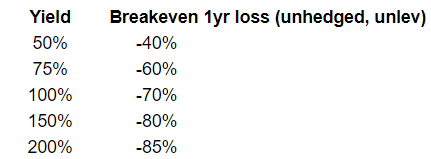

Execution of Unhedged UnLeveraged Defi

- Extremely high yield ‘risky asset + stablecoin‘ LPs: yield > 250%

- If price of risky asset in an LP drops 90%, the LP doesn’t, it drops to 32%, as it is half stable coin.

- The yield is multiplied by the asset value (32% of original). See Calculator above.

- If yield > 250% then only lose if risky asset drops MORE THAN 90%.

- Entry: Check yield and tokenomics potential dilution (put that in GSheets)

- Exit:

- Hold for a year

- Watch watchlist in Coinmarketcap to see if goes below 90% from entry – if so, then exit.

- Exit if yield drops below 250%.

- Sizing: Wtd EV ~0.2 (proxy by 0.5 W, 1.4:1 payoff)

- Only leverage an LP if it is hedged, as IL becomes massive in leveraged LPs (see calculator) cell K129 area.

- If price of risky asset in an LP drops 90%, the LP doesn’t, it drops to 32%, as it is half stable coin.

- Don’t do: Extremely high yield pairs which are correlated – NO! Correlation is fleeting and massive swings possible (AVAX/FTM in 2H21).

Systems

- Trend (3Commas): List of coins

- Daily trend

- Portfolio multi symbol with 3Commas

- MVIS25 index Perp on FTX with 3Commas (two DCh systems). Check perpetual payments on FTX

- ST trend (no longer)

- Daily trend

- 3 month breakout on TV

- HODL

- Short: automated in 3C

- Daily: BTC,ETH,MATIC; EMA85 + MACDhist condition

- Defi

- Defi

- For PCVs, trade based on discount to Treasury Value as the APY is dilutive (Bludex’s reviews in Medium) and compare staking to ‘minting and claiming’ ev 5 days or after claiming ended, so not diluted: Calculator

- Defi

- ICOs and NFTs (do WEIT to buy wholesale and sell retail)

Other links

- Sizing and tracking GSheet

- 3Commas

- Master initial Doc

- Map of crypto trading on Mindmup.

- FTX Premiums

- Binance Premiums

- Convert Binance premiums to annualised so can compare with FTX premiums

- Anyswap Bridge explorer to find funds – paste in your wallet address

Defi – the key is ss and dd like for all other alpha, and low IL

- Net demand for trading on an LP gives trading volume which gives fees

- Utility for a coin

- Choose the highest volume platform as that is where most people go, by definition.

- Choose the best LP on a platform – look at trading volume again.

- Low supply of alternative trading locations:

- No major CEXs for a coin. A small CEX is fine as people won’t be bothered with the account setup.

- Not many other DEXs

- Low IL

- Defi or all-in, given impermanent loss? A: IF expected return > 200% probably better All-In. ELSE if yield above 60% probably better in LP as it counteracts IL. See chart below:

- Source: https://solfarm.medium.com/solfarmers-education-leveraged-yield-farming-369be98e7acc