Beliefs

Buffett and the Intelligent Investor’s approach still works. Bill Ackman read the latter. It is based on growth and value.

Process

Buffett and Ben Graham

- #1: Margin of safety.

- #2: If Mr Market offers a price below value, take it. If he offers a price above value, either hold or sell.

- #3: Mindset: Owning part of a company – don’t mind if market closes for a year. If you don’t want to own it for 20 years, don’t own it for 10 minutes.

- Not many opportunities in life or investing (maybe 1 a year) so take them fully – it makes all the difference (Munger and Soros).

- Value based on DCF, whether bonds or stocks, growth stock or not, smooth earnings or volatile. Buy if price << value. The margin of safety is critical.

- Earnings outlook: Buy part interests in easily understandable businesses whose earnings are virtually certain to be materially higher five years from now.

Ackman’s 8 principles:

- Simple predictable free cash flows.

- Dominant companies with large barriers to entry.

- High returns on capital.

- Limited exposure to extrinsic risk we can’t control.

- Strong balance sheets – low debt.

- Don’t need access to capital to survive – has cash or cashflow.

- Have excellent management.

- Good governance.

Buffett

- Amortisation shouldn’t be deducted as generally goodwill increases in reality, and if business is sold will be higher in a good business. Depreciation should DEFINITELY be deducted – deduct the LTM amount as prior amounts aren’t relevant. For cashflow, add depreciation back to net income, and deduct capex. He uses the last few years’ average capex.

- Companies with high cash return/equity gain over time due to retained earnings (more specifically cash, and how it is reinvested). Alternatively it is paid out in dividends or share buybacks (e.g. for Coke, which can’t reinvest all its profits).

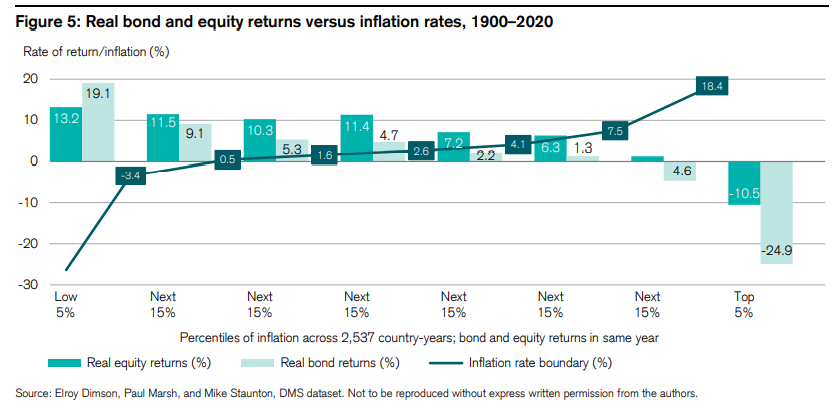

Real returns for bonds better than stocks only when lowest inflation, both have real losses in highest inflation

CS Yrbook 2021