- Drawdown is from the peak – always know your highs! (Google Sheets)

- …not from your mental set point/investment level. The account value is yours.

- …not from your mental set point/investment level. The account value is yours.

- On or off?

- VIX and contango thresholds on systems and stocks to start or stop them – follow it! Based on testing

- VIX and contango thresholds on systems and stocks to start or stop them – follow it! Based on testing

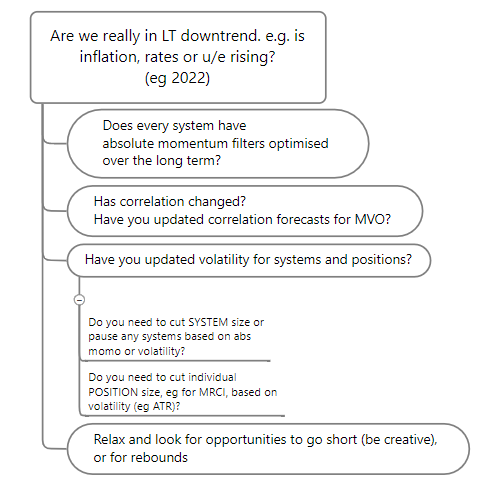

- Resize and re-correlate: When VIX>40 MUST resize and re-correlate based on:

- Volatility: Current 20d voly: Using long term averages or predictions will cause positions to be too large

- Correlation: Current correlation: 20d and 40d weights but only 33% LT after scaling; so much more weighted to recent.

- Resize FXCM positions based on 1/(31d voly/LT vol.) – don’t separately as not included in RD.

- Follow systems! Don’t get emotional about stocks.

- Put trades on even if like a stock, like an ASX PLM stock. Money is money – it is fungible. You can always get back in.

- If I had followed my systems I would have broken even in a massive crash: The three cases this month relate to fear and over-confidence. Emotions are massive in trading:

- I had fear my VXZ long position would be too large, and it could fall if the market corrects. So I only put on 2/3 size. Well, the price basically doubled and I left a lot on the table.

- I had fear and took off a long VIX call position I bought at 15 VIX when VIX hit 40. If I had held until 7 days before expiry (which was my system) I would have made US12,000 more.

- I had over-confidence my PLM stocks would be solid, so I didn’t hedge/sell when I should have.

- Be net long always: Always know long / short net position (Excel) including negatively correlated things like VXZ

- Calculate accurate recent betas in Excel.

- If you like money then cautious optimism must always be your default state. CSFB Yearbook – long term equity returns. People got stuck bearish from 2008 for 12 years…. You need a lot of evidence the market has mispriced things to hold on to a bearish thesis. Markets are forward looking. Markets bottom on the ugliest forward expectations (James).

- Do basic DCF on revenue reduction; see effect on NPV of FCF.

- Hedge

- Use MES futures to hedge if need to act fast, eg vs PLM stocks

- If LMT orders in illiquid markets (PLM) use short MES to hedge until orders filled.

- VXZ is a brilliant hedge – the best. TLT is OK

- It has both backwardation and high VIX on its side. It went up consistently.

- TLT is OK but it broke down as so many constituents to price, and also yield became 0.

- Don’t take profits on short hedges too early – you don’t know how far it will go

- OTM 7delta VIX options would have made US$12k but I sold them at VIX=40 (VIX went to 70)

- OTM 7delta VIX options would have made US$12k but I sold them at VIX=40 (VIX went to 70)

- Use MES futures to hedge if need to act fast, eg vs PLM stocks

- WHEN THINGS BREAK DOWN – GET INTO VGSH OR CASH! Things may change, adapt

- A takeover offer will cease in a crisis. Sell takeover stocks before they do, eg NSR.ASX

- Bond ETFs may go up so much that they start to dislocate internally from pricing disparities (TLT, BND:AGG)

- Corporate bonds may collapse as large companies expected to go bust (LQD).

- Oil may drop 30% in a day as Saudi Arabian and Russian talks break down (03-20).

- A currency can swing 10% each way. Europe was safe, then got hit with coronavirus

8. VXX has a lot of contango, but VXZ holds up very well with good hedging and little contango, even after 50% SPY COVID19 recovery 1H20.