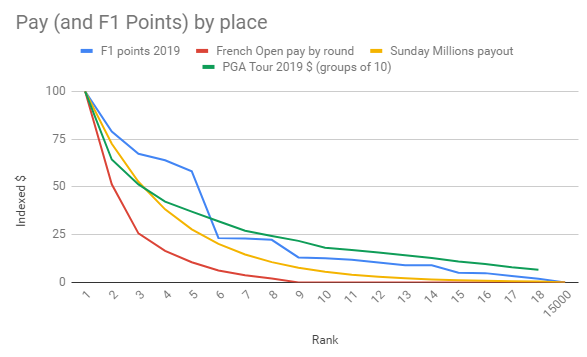

Trading is like F1 racing, poker, tennis, golf

The top few take almost all. 99.8% make ZERO or lose after playing costs.

Tending the Garden

Trading is like tending the garden. It grows over time. A long time. Take that attitude (insight 19-11-2019).

I Take And Manage Risk. I Have To (insight 19-11-2019)

- Life is risk.

- List all risks of each thing. Mitigate and manage them until reward is > risk, else say no.

- I embrace risk.

Customer service has power and can cut you off (19-11-19)

Always be charming to broker customer service

It is all about p (like my company name) given current, not current (05-03-20)

- The stock market is NOT the economy. It is 6-9 months ahead.

- “Bad thing ==> stock market is going to go down” isn’t reality. Reality: “Bad thing ==> stock market is already down”.

- Markets are constantly adjusting prices to reflect investor expectations about the future. As a result, meaningful changes in prices will only occur if investors receive new information that is inconsistent with current expectations. When this happens, investors experience a shock, which causes them to adjust the price of assets higher or lower to reflect this new reality.

- Don’t panic sell when a bad thing happens — unless you have informational edge from this point on, and don’t greed sell when high profits – unless you have informational edge from this point on.

- The tendency of nearly all active traders and investors is to under-perform by serially selling low and buying high. A potential source of edge is to do the opposite of what your fear is telling you to do.

- It IS important to be risk-averse – which you largely manage through diversification and appropriate sizing.

If wrong trade or size, get out immediately. Don’t wait for down/up day

If wrong trade or size, get out immediately. Don’t wait for down/up day. Did this with short ES hedge 04-20 and market went straight up 20% before I bit the bullet. Won’t have natural trade exit if not part of a system.

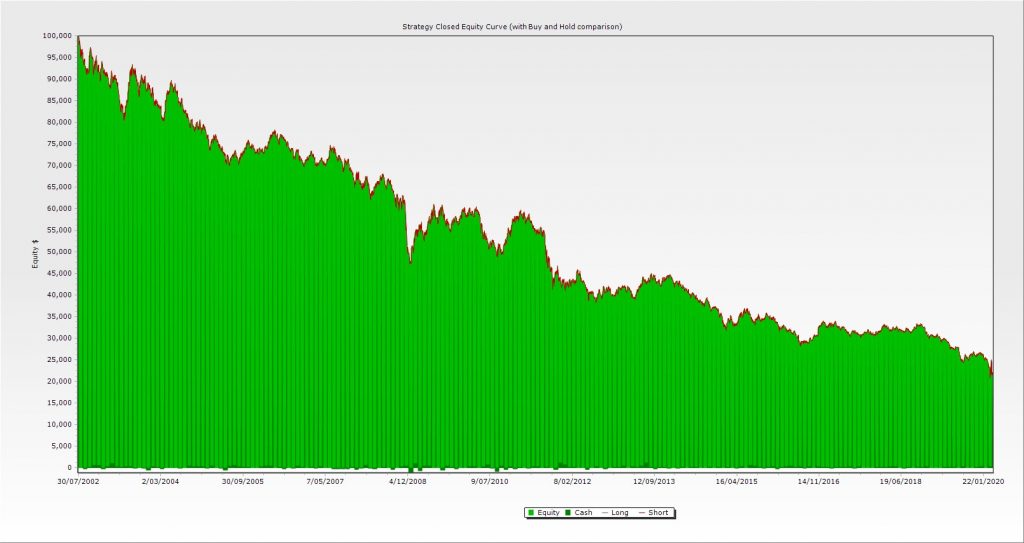

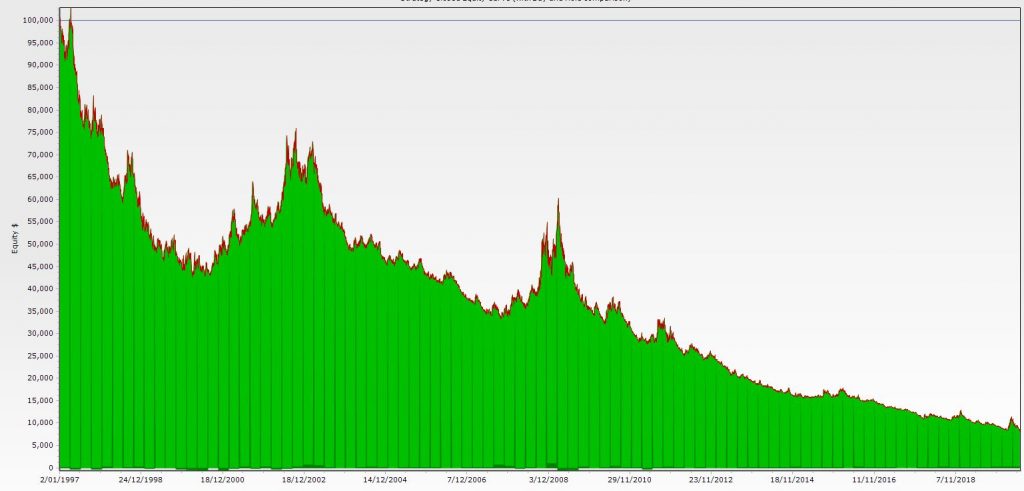

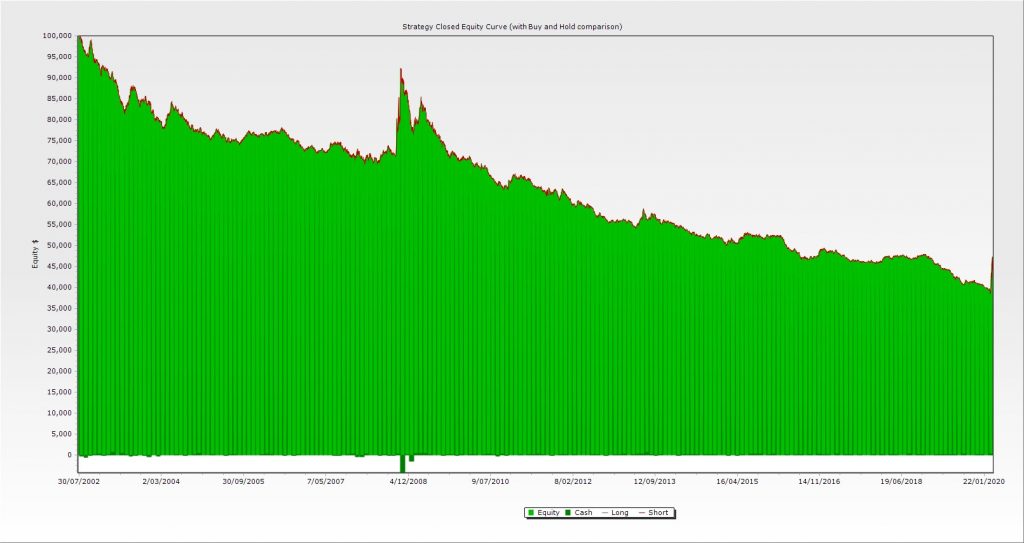

Don’t fight the Fed. Don’t short equity or debt

TLT short rebalanced monthly 2002 – 03/2020, no slippage

SPY short rebalanced quarterly 1997 – 06/2020, no slippage.

70% losing quarters. Looks the same with monthly rebalancing.

LQD short rebalanced monthly 2002 – 03/2020, no slippage

Right market size/exchange/sector (11-2020)

The US market is NOT homogenous. The following indices can all track VERY differently and make MASSIVE difference to the BA system and other systems: $COMPQ (Nas comp), QQQ (Nas100), SPY (S&P500), $OEX (S&P100), IWM (Russell2000), $XYX (Amex comp), $NYSE (NYSE comp).

Change, this moment (insight Good Friday 2020)

Trading in the ever evolving moment of now

- What combination of trades are best in this moment?

- What individual system weighting is best in this moment? Not what was best over the last 10 years. In two weeks, or one year, same questions.

- Life and the markets are dynamic – they change.

Druckenmiller’s prediction adages

- “Never, ever invest in the present. You have to visualise the situation 18 months from now, and whatever that is, that’s where the price will be today. It doesn’t matter what a company’s earning, what they have earned.”

- “Earnings don’t move the overall market; it’s the Federal Reserve Board/liquidity.”

- “The only way to make long-term returns in our business that are superior is by being a pig. Soros has taught me that when you have tremendous conviction on a trade, you have to go for the jugular.”

- “If something needs to be hedged, you shouldn’t have a position in it.”

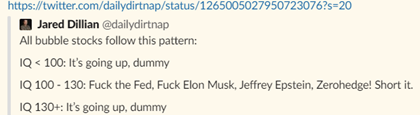

- “Good investors are successful not because of their IQ, but because they have an investing discipline. But, what is more disciplined than a well-researched machine?”

- “George Soros has a philosophy that I have also adopted: The way to build long-term returns is through preservation of capital and home runs.”

- “Soros is also the best loss taker I’ve ever seen. He doesn’t care whether he wins or loses on a trade. If a trade doesn’t work, he’s confident enough about his ability to win on other trades that he can easily walk away from the position. There are a lot of shoes on the shelf; wear only the ones that fit.”

Risk and reward are 100% time related (RB 05-20)

Skew: How is skew best taken into account?

MC over period incl two crashes. Adjust sizing.

Simplicity on the other side of complexity

You’ve been able to synthesize the content into your own worldview, and you’ve discerned the essence of the idea in such a simple, direct way that you can communicate it to other people.

There is nothing to fear from corporate tax returns

Tax: There is nothing to fear from corp tax returns. In the end they are just numbers, dates, and pieces of paper (LP UK return in NZ 04-07-20)