Never short an ETF

In control of the IBank. They put DGAZF trading OTC overnight and then screwed all the shorts.

Use manual LMT or SNAP TO PRIM (or SNAP TO MID) before close, not REL, on illiquid securities

James enters manually in last 90 minutes of day (but not last 10 minutes as spread widens). Most algos (eg REL) can be gamed by dealers.

He assumes getting worst fill. If not happy with it, then finds more liquid option. THEN: he bids between midpoint and ask if price trending. If no one interested, he drops it to fish, or just hits offer. Main thing is to “get it done”.

IB Adaptive Algo on liquid securities.

Auditing systems

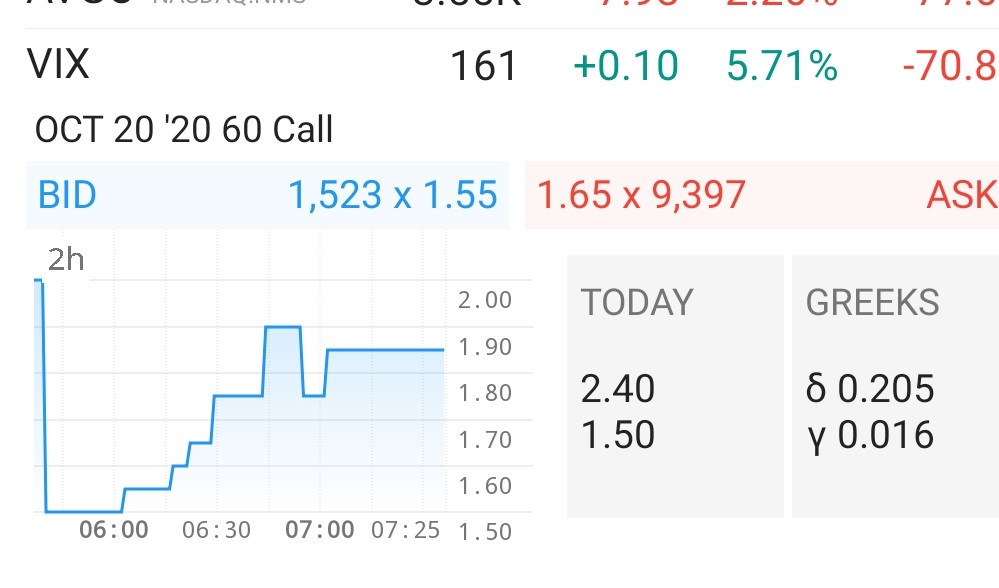

Orders and fills

Get trades emailed to you automatically. Compare daily on 1min chart in Stockcharts or TradingView. For spreads look at chart in broker platform. If error, ask broker.

Commission

Monthly, calculate BA tiered commission paid vs what fixed would have been. Separate buy and sell trades as sell trades have the transaction fee.

BA

If issue, put current list in WL, same account size and voly lookback. Compare fills, size, profit, weekly returns.